File your Form

990-N and 990-EZ

with Expert Support

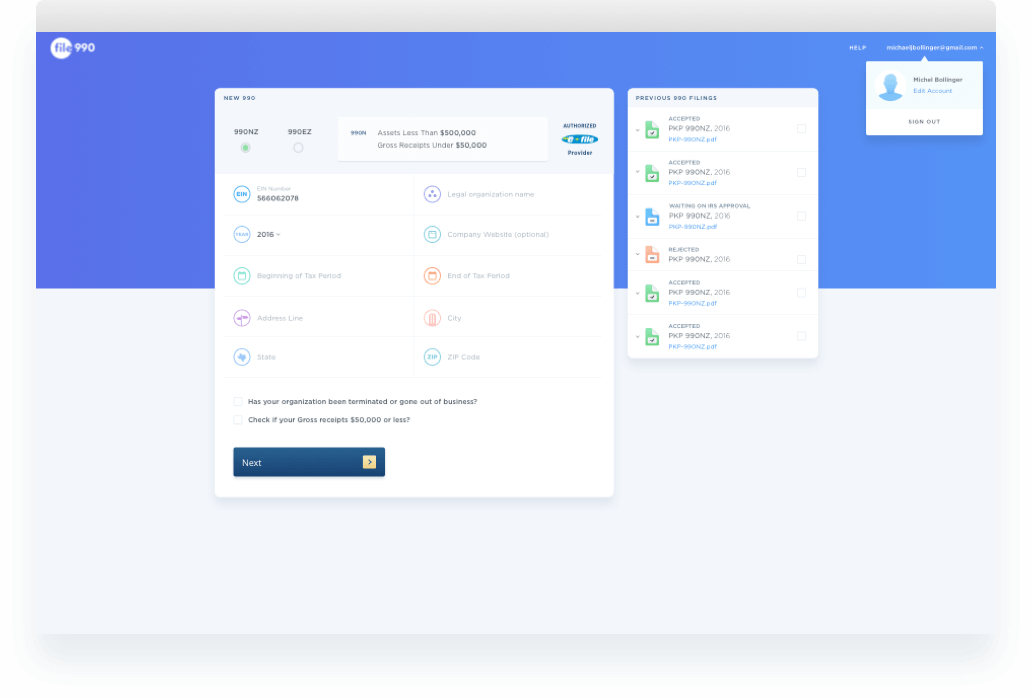

File 990 is the fastest, safest and easiest way to e-file your IRS Form 990 N or 990 EZ return. Complete and submit your current and previous year's forms directly to the IRS in minutes without the costs of working with a professional accountant. Receive IRS acceptance notifications on your dashboard within a few hours. Simply put, we do the heavy lifting for you so you can achieve your mission.

Provider

Provider

Learn More About File 990’s Enterprise Platform

Streamline your nonprofit organization’s tax filing with our enterprise platform. Complete the form below and a File 990 representative will be in contact soon.

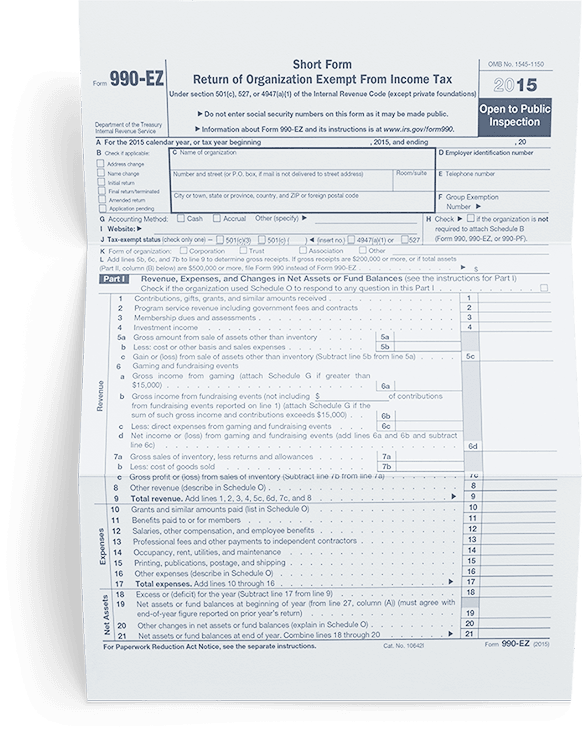

Form 990-N & 990 EZ E-filing Made Easy

File 990 imports all relevant data about your nonprofit directly from the IRS database. You just need to know your nonprofit organization's tax EIN, and we’ll get the return started for you.

-

Secure 990N & 990EZ Interface

File 990 uses bank-level security to keep your personal information safe while e-filing your nonprofit’s taxes. As an authorized IRS e-filer, you can rest assured your 990-N and/or 990-EZ return will be submitted securely to the IRS.

-

Never File Your 990-N & 990 EZ Late Again

We’ll remember your fiscal year and remind you when next year’s 990 form submission deadline is approaching. We’ll also save all of your data, making the next filing a breeze.

-

Fast And Easy Filing For Your 990 Forms

File your tax return in minutes, not hours. File 990 imports all of your nonprofit’s necessary data directly from the IRS database—all you need to provide is your EIN number and answer a few easy questions, and we’ll handle the rest. We can even reference previous filing information to fill out your form faster.

Fair Pricing for Mid-sized to Small Nonprofits

Hiring an accountant to handle your nonprofit’s tax forms can be a significant financial burden, especially for organizations that qualify for forms 990 N and 990-EZ. With pricing starting at just $54.99 for 990 N and $84.99 for 990-EZ, File 990 is the best bang for your buck come tax season.

We Help Nonprofit Organizations With Multiple Components File 990EZ

Managing multiple chapters or components? No problem. Keeping track of hundreds of chapters and components can be a huge undertaking. Our nonprofit tax e-filing platform automatically tracks the filing status of each component and sends reminders to you when it is time for them to file. Our group-filing system turns weeks of time spent filing time into minutes.

Never lose component exempt status

File 990 lets you filter to identify components that may lose their exempt status if you fail to file this year. This makes it easy to focus on your nonprofit groups that may need the most assistance.

Track Component Filing

Import your EIN list to view all your component tax filings and their progress in real-time. You can easily find necessary information by sorting filings by year or organization.

Remind Components To File

Each of your chapters or component groups will receive an email when it’s time to file their Form 990. Treasurers don’t even need to know their EIN to file their nonprofit return—they just have to click the link in the reminder email to begin the filing process.

Form 990EZ and 990N FAQs Answered

What is Form 990EZ and 990N?

These IRS forms must be filled out by nonprofits with gross receipts up to $200,000 in order for them to keep their tax-exempt status. They require the nonprofit’s financial information, program accomplishments, and more. Read this guide to learn more about the required information for each form.

Why do these forms matter for nonprofits?

There are significant advantages to filing your forms correctly and on time. By doing so, nonprofits can avoid a fine of at least $20 per day, potential loss of tax-exempt status, and additional fees for reapplying for tax-exempt status. Plus, Form 990 and its variants can help boost transparency between nonprofits and their supporters by providing a record of financial activity.

How can nonprofits file Form 990EZ and 990N?

Since these forms are more streamlined versions of Form 990, qualifying nonprofits can fill them out relatively easily. Follow these easy steps to file a Form 990 EZ or 990-N:

- Gather the required information, such as the leadership team's contact information, expense reports, and receipts.

- Make an account with File 990, the top IRS-certified e-filing solution, to kickstart the process.

- Upload the necessary data to the correct form based on gross receipts.

- Submit the form to the IRS instantly through File 990’s integrated portal.

That’s really all there is to it! Plus, File 990 can save forms from previous filing years to improve future filing seasons.

Provider

Provider