As a nonprofit professional, you’re familiar with the yearly maintenance that ensures your organization’s continued success: filing Form 990 with the IRS.…

read more501(c)(3) Status Revoked? Here’s How to Recover Easily

Filing Form 990 is an essential—or, depending on your point of view, inevitable—part of nonprofit governance. However, filing your tax forms accurately…

read moreIRS Form 990EZ Deadline: Important Information for 2025

If you’re a mid-sized nonprofit, filling out the standard Form 990 might feel overwhelming and time-consuming. Fortunately, there’s a form meant…

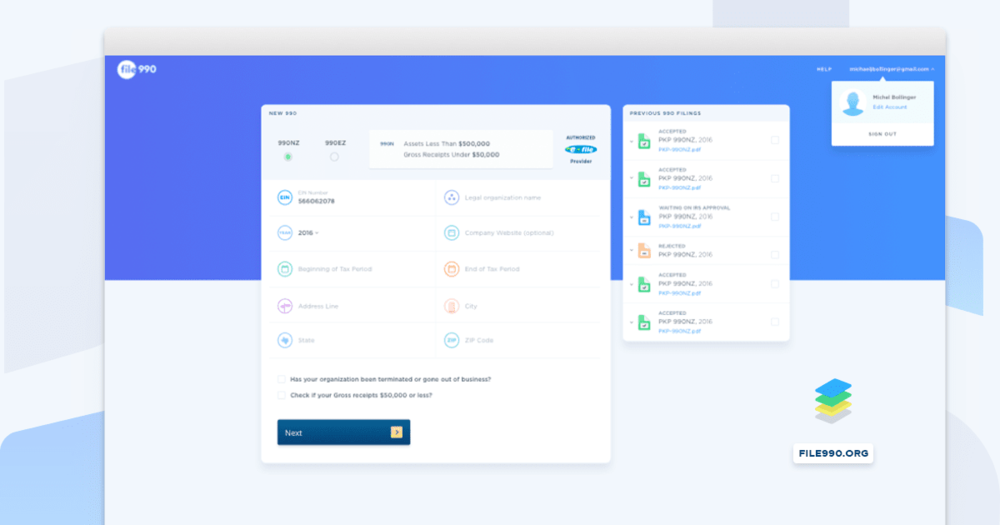

read moreE-file Form 990N Postcard: How-to-File Guide for Nonprofits

990-N Postcard FAQs What Is the Form 990N Postcard? When is the deadline to file the Form 990-N postcard? How do I File the 990-N Postcard? What solution…

read moreHow to File Nonprofit Taxes: Simple Strategies for Success

Most of the 1.8 million nonprofits operating in the United States have one crucial aspect in common—their tax-exempt status under the Internal Revenue…

read more990-EZ vs 990-N: How to Tell the Difference + Other FAQs

One of your small nonprofit’s most significant duties is filling out your IRS tax forms. Not only does filing these forms on time maintain your…

read more990EZ for Nonprofits | Everything You Need to Know to File

One of the key benefits of running a 501(3)(c) nonprofit is the tax exemption that comes with it. But once you’ve filed your Form 1023 and been granted…

read moreDo I Need a Tax Accountant for My Nonprofit?

It’s officially tax season. You know, that time of year that some people dread, others don’t mind, and a few even get excited about. And, not only are you…

read moreDoes My Nonprofit Have to Pay Taxes?

As a United States citizen, you are legally required to file your personal taxes annually; and this is regardless of your financial situation, or whether…

read moreWait, I Have to File Form 990 Electronically? Updates on New IRS Rules.

A change in the form 990 instructions for nonprofits filing in 2020 will require you to file your form 990 electronically. Previously, organizations have…

read more